Frequently asked questions

What is Taxxa Accounting and Taxation Software?

Taxxa is a comprehensive accounting and taxation software designed to help businesses manage their financial transactions, GST compliance, invoicing, and tax filings efficiently. It is tailored for Indian businesses to meet statutory requirements like GST, TDS, and income tax.

Who can use Taxxa Accounting Software?

Taxxa is suitable for:

Small and medium-sized businesses (SMBs).

Chartered Accountants (CAs) and tax professionals.

Freelancers and startups.

Businesses looking for GST-compliant solutions.

What are the key features of Taxxa Accounting Software?

GST Compliance: GST invoicing, filing, e-way and E-invoice bill generation.

Financial Accounting: Ledger management, balance sheets, and profit & loss statements.

Taxation: TDS calculation, income tax filing, and GST returns.

Inventory Management: Track stock levels and manage inventory.

Bank Reconciliation: Sync bank transactions and reconcile accounts.

Reporting: Generate financial and tax-related reports.

Is Taxxa GST-compliant?

Yes, Taxxa is fully GST-compliant. It supports:

GST invoicing with HSN/SAC codes.

GST return filing (GSTR-1, GSTR-3B, etc.).

E-way and E Invoice bill generation.

Can I file GST returns directly through Taxxa?

Yes, Taxxa allows users to prepare and file GST returns directly from the software. It also provides error-checking tools to ensure accurate filing.

Does Taxxa support TDS and income tax filing?

Yes, Taxxa supports:

TDS calculation and deduction.

TDS return filing (Form 26Q, Form 24Q, etc.).

Income tax filing for businesses and individuals.

Is Taxxa cloud-based or desktop software?

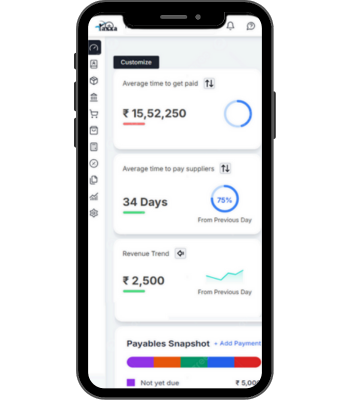

Taxxa is typically available as cloud-based software, allowing users to access their data from anywhere with an internet connection. Some versions may also offer offline functionality.

Can I manage inventory with Taxxa?

Yes, Taxxa includes inventory management features to help businesses track stock levels, manage orders, and generate inventory reports.

How does Taxxa handle bank reconciliation?

Taxxa allows users to:

Import bank statements.

Automatically match transactions with ledger entries.

Reconcile accounts to ensure accuracy.

Is Taxxa suitable for small businesses?

Yes, Taxxa is designed to cater to the needs of small and medium-sized businesses, offering affordable and scalable solutions.

What is the pricing of Taxxa Accounting Software?

Pricing may vary based on the plan and features selected. Typically, Taxxa offers:

Monthly or annual subscription plans.

Custom pricing for CAs and tax professionals.

Free trials or demo versions for new users.

Does Taxxa offer customer support?

Yes, Taxxa provides customer support through:

Phone and email support.

Online chat.

Help documentation and video tutorials.

Can I use Taxxa on mobile devices?

Yes, Taxxa offers a mobile app or mobile-friendly interface for users to manage accounting and taxation tasks on the go

How secure is my data with Taxxa?

Taxxa uses advanced security measures like:

Data encryption.

Regular backups.

Secure cloud storage to protect user data.

Can I migrate my existing data to Taxxa?

Yes, Taxxa allows users to import data from other accounting software or Excel sheets for a seamless transition.

Does Taxxa support multi-user access?

Yes, Taxxa supports multi-user access with role-based permissions, allowing teams to collaborate efficiently.

Can I generate financial reports with Taxxa?

Yes, Taxxa enables users to generate various financial reports, including:

Balance sheets.

Profit and loss statements.

Cash flow statements.

GST and tax-related reports.

Is there a free trial or demo available?

Yes, Taxxa typically offers a free trial or demo version for users to explore its features before purchasing.

How do I update Taxxa software?

If Taxxa is cloud-based, updates are automatically applied. For desktop versions, users may need to download and install updates manually.

Where can I download or purchase Taxxa Accounting Software?

You can download or purchase Taxxa from its official website or authorized partners. Visit the website for more details.